9 min read

Guide: Digital Identity Wallets Explained

February 25, 2025

With Gartner predicting over 500 million users of digital identity wallets by 2026 and the decentralized identity market expected to reach $3 billion by 2031, the shift toward Digital ID Wallets is already well underway.

Their momentum is driven by the rise in mobile interactions, increasing demand for stronger data protection against unnecessary collection of personal data by organizations, and new regulations aimed at improving identity verification in the face of rising digital crime.

As a result, identity verification processes have become a maze—who hasn’t been frustrated by having to scan your ID, snap a selfie, and confirm your identity multiple times, just to access a simple service? It feels like jumping through hoops, and it only gets worse with every added layer of security.

In response to these issues, ID Wallets put security, privacy, and user experience front and center, offering a level of convenience and protection that once seemed impossible but is now a reality.

What are Digital ID wallets?

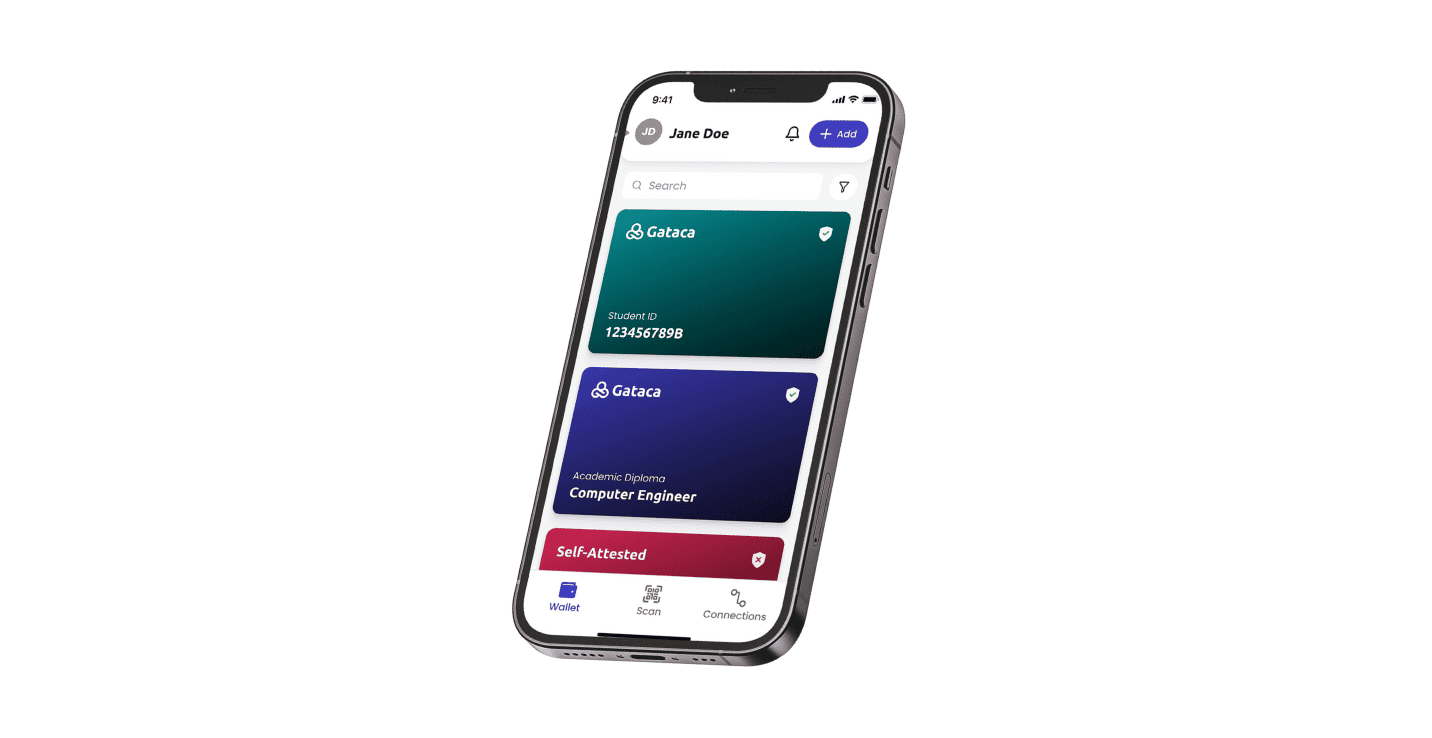

A digital ID wallet, such as the Gataca Wallet, is a mobile or web app where you can securely store identity documents in the form of verifiable credentials to prove who you are and/or share specific personal data to sign in to services.

The credentials are stored in an encrypted, digital format and can contain various types of information about a person or a legal entity.

Think of it like the digital wallets you use for purchases, but going one step further: instead of just payment methods, these wallets store important documents like national IDs, passports, driver's licenses, diplomas, health records, and more.

However, the growing popularity of Digital ID Wallets is not just due to their unmatched convenience. The reason is that they give users full control over their data. You can decide who has access to your information and when to stop sharing it, putting control of personal data back where it always should have been—with the user.

How Digital ID Wallets Work

1. Getting your credentials

You can request credentials from trusted sources, such as:

- Government agencies (e.g., national ID, driver’s license)

- Banks (e.g., account verification)

- Schools & universities (e.g., diplomas, certificates)

- Employers (e.g., work IDs, professional certifications)

These institutions verify your identity before issuing a Verifiable Credential (VC) into your ID Wallet—a cryptographically signed digital document proving the claim's authenticity.

In some cases, you can also self-issue credentials, like your email or phone number. While these aren’t verified by an official source, they can still be shared when needed.

2. Storing your credentials

Once issued, your credentials are stored securely in your Digital ID Wallet—a protected, encrypted vault. Only you can access it using authentication methods like biometrics (fingerprint/face scan) or PIN codes.

3. Sharing credentials

When an organization (like a bank, employer, or online service) asks for verification, you simply:

a. Scan a QR code b. Choose which credentials to share c. Approve the request with a tap

Verifiable credentials are reusable, so no more remembering usernames and passwords or repeatedly filling out forms! The organization instantly verifies your credentials using cryptographic signatures—without needing to contact the original issuer or manually review the information.

4. Revoking access anytime

You have full control over your credentials. If you’ve shared access to a credential with a service, you can revoke it at any time, ensuring privacy and security.

What can I do with a Digital ID Wallet?

Digital ID Wallets allows you to access a wide range of services and transactions, both online and offline.

This includes applying for public services, opening bank accounts, university applications, storing medical prescriptions, or securing transactions without carrying paper copies of ID documents or dealing with scanned copies.

Practical Example

Imagine applying to open a bank account. Normally, this process involves submitting various documents, such as proof of identity or address. There’s often a lot of back-and-forth if anything is missing or unclear, especially with cross-border customers dealing with different document formats and languages.

With a Digital Identity Wallet, a customer would simply respond to the bank's verification request by selecting the required documents stored in their wallet, all in a global standard format. For example, the customer might select a national ID and proof of address, such as a utility bill or bank statement.

The bank instantly verifies the information using the already verified, cryptographically signed Verifiable Credentials. And just like that, the customer is onboarded and granted access to their bank account—all in seconds!

Benefits of a Digital ID Wallet

The advantages of using ID Wallets can vary depending on your situation, but one thing is certain: adopting them benefits both organizations and end-users.

Benefits for individuals

- Convenience: ID Wallets facilitate online verification as users can prove who they are or any information about themselves with just one click anywhere at any time. No more repetitive data entry, document uploads, or awkward selfies.

- Portability: Users can store and access all their digital credentials from a single app on their mobile device, eliminating the need to carry multiple physical documents.

- Global recognition: Verifiable credentials adhere to international standards, ensuring they are recognized and accepted globally.

- Data Control: Individuals have greater control over their data. They can choose what data to share and with whom. They can also opt to disclose only specific details, such as sharing just their name and last name without revealing their address when sharing a National ID.

- Robust Protection: Verifiable credentials are fortified with cryptographic security so they can trust that their personal information remains secure.

Benefits for organizations

- Increase Security: ID Wallets use biometrics, strong encryption, and distributed storage to minimize the risk of large-scale data breaches.

- Enhance User Experience: ID Wallets give users passwordless, instant access to online services, eliminating friction during onboarding and lowering abandonment rates.

- Costs Saving: Reduce operational expenses related to customer identity verification processes, compliance, and data storage.

- Reduce Identity Fraud: Verifiable credentials use advanced cryptography so you can automatically verify their data authenticity and issuer organization.

- Lower Admin Burden: Ease operational processes by reducing paperwork and verification hurdles.

Global landscape of Digital ID Wallets initiatives

This past year has been marked by an exponential growth in demand and interest in ID wallets worldwide.

One notable development has been the approval of the eIDAS 2.0 regulation in Europe, introducing the European Digital Identity Wallet.

The EUDI Wallet is a free mobile app that the Member States will make available to both individuals and businesses to store and share verifiable credentials.

Therefore, the EUDI Wallet will make it easy for users in the European Union to prove their identity and share personal information online, whether for government services, online shopping, or other internet platforms.

As a result, all European countries are advancing their digital identity initiatives in preparation for the European Digital Identity (EUDI) Wallet. Some examples are:

Germany

Germany is actively developing its digital identity infrastructure through the "SPRIND Funke EUDI Wallet Prototype" initiative, which ends September 2025. Launched by the Federal Agency for Disruptive Innovation, this innovation competition seeks to develop and test technical solutions for future German EUDI wallets in the form of prototypes.

France

France has launched "France Identité", the French EUDI Wallet prototype. Among its use cases, is the use of National ID cards as a digital solution for presenting tickets on the TGV, France's high-speed train network.

Italy

Since December 4, 2024, all Italian citizens and residents can add digital versions of their driving licenses, health insurance cards, and disability cards directly into the IT Wallet, Italy’s EUDI Wallet.

Austria

Austria has complemented its digital identity solution "ID Austria," with the "eAusweise" app, which allows citizens to carry digital versions of their identification documents, such as driving licenses, national IDs and proof of age, on their smartphones.

But ID Wallets popularity is not limited to the European Union:

- The United Kingdom has announced that it will launch a Gov.uk digital wallet this year for easier access to public services.

- Switzerland has announced plans to start issuing eIDs in a wallet app called ‹SWIYU› from 2026 and explore interoperability with the EUDI framework.

- In the US, the Department of Homeland Security (DHS) has selected six firms for an initiative for the development of digital credential wallets. Additionally, 15 states are already accepting mDLs in ID Wallets at TSA security checkpoints.

- South Korea started a trial in January 2025, allowing citizens 17+ to store resident registration cards on smartphones. Piloted in nine regions, nationwide rollout is expected by March.

- Australia’s new digital ID system promises that will include all key documents in a single digital wallet, making it easier for citizens to access a range of services.

Digital Identity Wallets Open Challenges

- Loss of Device

Although Digital Identity Wallets are protected by encryption and biometrics, losing the device means losing access to stored information, as it is kept locally. This creates inconvenience and potential risks if proper recovery mechanisms are not in place.

Implementing safeguards such as biometric authentication, multi-factor authentication, remote wiping, and secure backup options can mitigate this issue.

- Regulation and Interoperability

Digital Identity Wallets must work across platforms, providers, and jurisdictions, but the lack of universal standards and regulations creates legal gaps and hinders interoperability. While still a work in progress, efforts are underway globally.

- Potential risk of profiling

ID Wallets store personal identification data that, if not properly safeguarded, could be combined with other information by service providers or third parties, enabling detailed user profiling. However, adopting a strict privacy-by-design approach such as Gataca, ensuring data minimization, and enforcing strict access controls can prevent exploitation.

What’s the expected evolution of Digital ID Wallets?

Digital ID wallets are expected to evolve into SuperWallets—comprehensive digital wallets that integrate payments, digital signatures, digital asset management, and identity information into a single app.

- Payments: Many transactions require both identification and payment. Integrating payment capabilities into ID wallets simplifies the user journey by combining these steps.

- Digital Signatures: Transactions often involve agreements, some of which require legally binding digital signatures. Since these signatures must be tied to a verified identity, incorporating them into ID wallets is a logical step.

- Management of Digital Assets: ID Wallets will not only facilitate payments but also securely store and manage a variety of digital assets.

Get started with the Gataca Wallet

Available for download on both the Apple App Store and the Google Play Store, getting started is just a few taps away.

By downloading the Gataca Wallet, you’ll be able to begin securely storing your identity documents, managing who has access to your personal data, and using verifiable credentials to easily prove your identity for accessing services.

Esther Saurí

Digital Marketing Specialist