6 min read

Why ID Wallets Outperform Traditional KYC

August 6, 2025

We’ve all gone through it: uploading a photo of your ID, taking a selfie, waiting for approval, only to do it all over again on the next platform.

From the user’s side, it’s annoying. From the business side, it’s even worse with long onboarding times, high drop-offs, bloated data storage you’re responsible for protecting, and rising compliance costs.

That’s where ID Wallets come in. They let users complete a KYC once, store the verified credential on their phone, and re-use it across services, giving them full control over their data while making onboarding instant.

If you work in finance, iGaming, healthcare, or travel, this shift isn’t just technical, it’s strategic. And in the EU, it’s becoming mandatory under the new eIDAS 2.0 regulation with the European Digital Identity Wallet as the main component.

What is a KYC via ID Wallet?

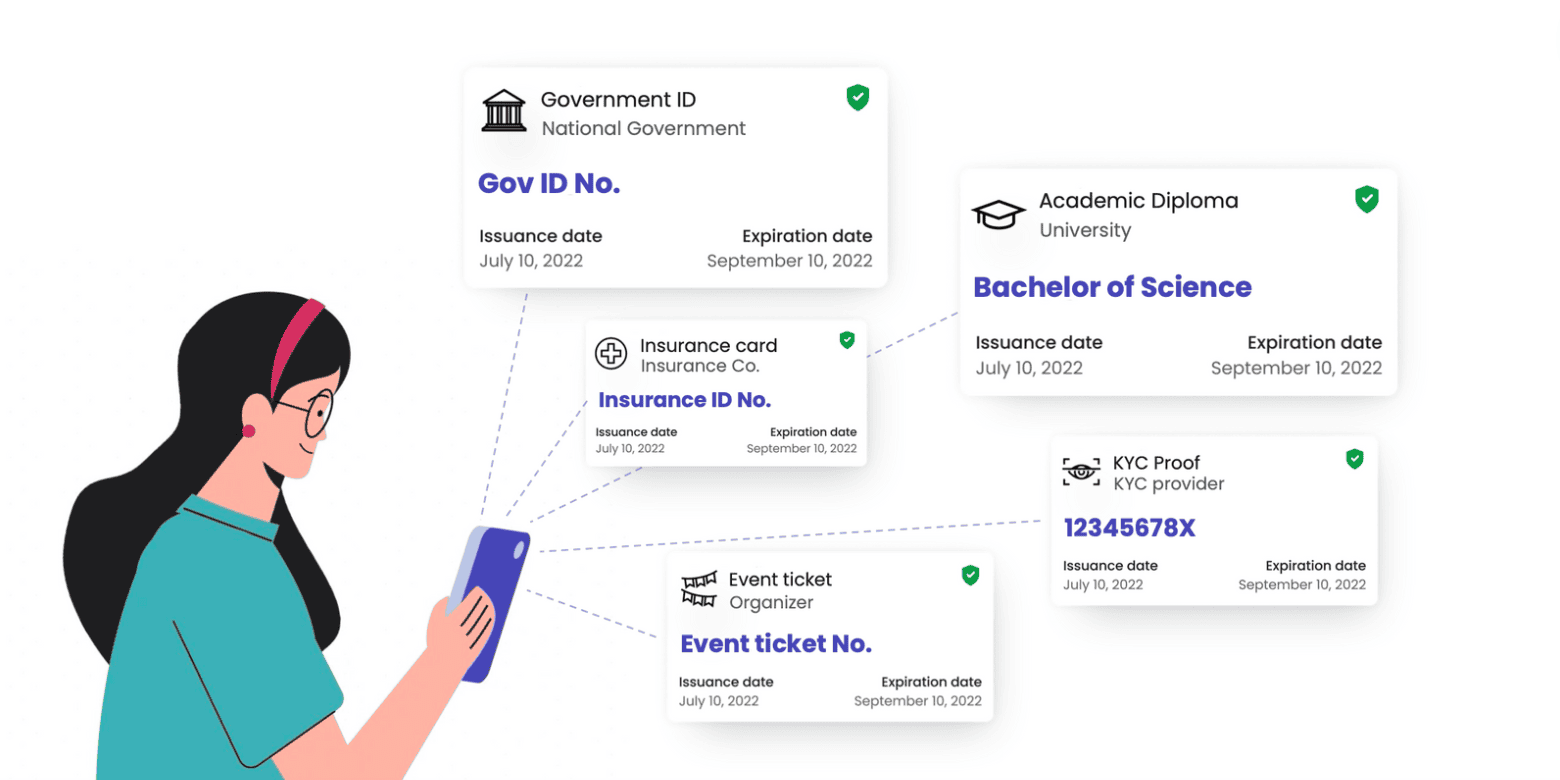

An ID Wallet (like the Gataca Wallet) is a secure mobile app that stores identity credentials—such as an ID document, drivers license, diploma or proof of address—in a form of verifiable credentials to allow users to easily prove who they are and/or share specific personal data to sign in to services.

Think of it like Apple Pay or Google Pay, but instead of payment cards, it holds your personal data or documents.

Here’s how it works:

- The user completes a KYC process once either through the wallet or an integrated provider.

- They receive a digital credential proving their identity which is issued to their ID Wallet.

- When signing up for a new service, they scan a QR code, share the credential in one tap, and they’re in.

No more forms, no repeated uploads, no waiting.

And because the credentials are interoperable, users can use them across multiple platforms and countries, not just within one ecosystem.

However, the growing popularity of Digital ID Wallets is not just due to their unmatched convenience. The reason is that they give users full control over their data.

They can decide who has access to their information and when to stop sharing it, putting control of personal data back where it always should have been: with the user.

Why Businesses and Users Are Switching to ID Wallets

ID Wallets don’t just simplify KYC; they flip the whole model in favor of the user while reducing risk and workload for the business.

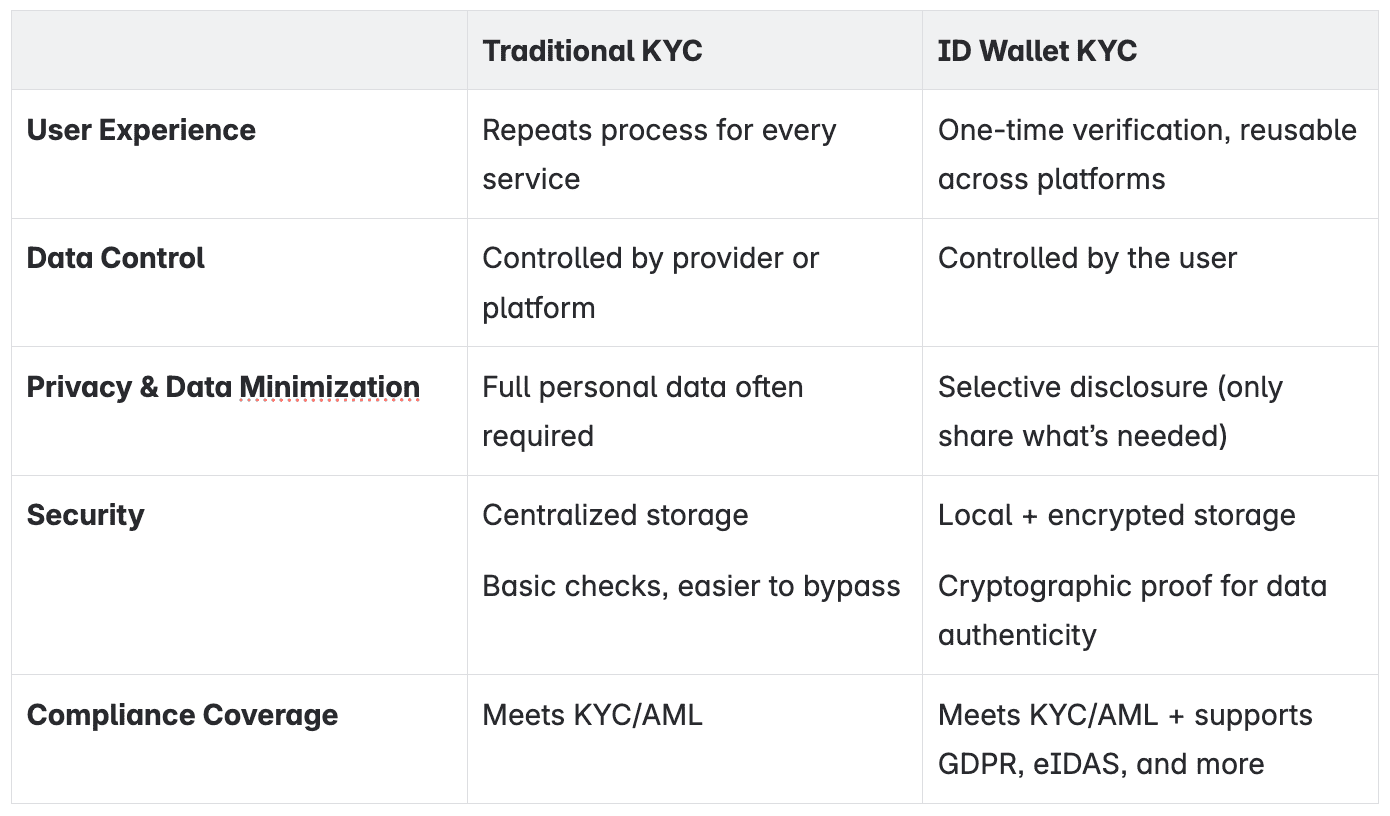

1. One KYC, Reusable Anywhere

Traditional KYC forces each new site to rerun all the checks, frustrating users and spiking drop-off rates.

With ID Wallets, users verify once and reuse that credential again and again.

For example, a user verifies once to open a bank account, then uses the same proof of identity to register for an iGaming platform in just one click.

2. Users Are in Control

In the old model, providers hold and manage user data in centralized databases with users having little to no control into how their data is used.

ID Wallets flip that model. Users store their credentials on their own devices and choose what to share, with whom, and when to revoke access, reducing your liability and aligning with data protection principles.

3. Privacy by Design

Most KYC processes over-collect personal data.

ID Wallets support selective disclosure, meaning users can opt to disclose only specific details, such as sharing just their name and last name without revealing their address when sharing a National ID or prove they’re over 18 without revealing their full date of birth. This limits data exposure and supports data minimization.

4. Built-in Security

KYC data stored centrally is a goldmine for hackers.

With ID Wallets, credentials are encrypted, stored on the user’s device, and protected with biometrics for maximum security. And even if a phone is lost, credentials can be remotely revoked.

There’s no central database to breach, removing a major point of failure.

5. Compliance Gets Easier

ID Wallets help with compliance by automating verification checks and ensuring adherence to data protection laws.

Moreover, in Europe, the new eIDAS regulation, approved in May 2024 and which will be enforced next year, mandates that every EU country must roll out at least one European Digital Identity Wallet by the end of next year and that private service providers who need strong user authentication will be required to accept ID wallets as a valid method for online verification.

Quick Snapshot: Traditional KYC vs ID Wallets

What Businesses Gain

For your users:

- Speed: One click onboarding. No repetitive uploads or forms.

- Convenience: Portable across services and globally accepted.

- Privacy: Share only what’s needed, nothing more.

- Security: Strong encryption and full control.

For your business:

- Lower drop-offs: Fast and simple onboarding means fewer users give up halfway.

- Less overhead: Reduce manual checks, paperwork, and compliance costs.

- Stronger security: Distributed storage to minimal risk of large-scale data breaches.

- Eliminate fraud: Advanced cryptography for data authenticity.

ID Wallets Across Industries: Use-Case Highlights

iGaming

Players hate KYC holdups, they just want to spin the wheel. Wallets let bettors verify age/identity once and play anywhere. Imagine a gambler who verified with one casino, then uses that credential for dozens more brands, eliminating re-verification delays and drop-offs. Faster play = higher acquisition and satisfaction.

Read our blog on ID Wallets in iGaming

Financial Services

Banks live by KYC, but customers dread it. A reusable ID means opening new accounts, applying for loans, or signing up for fintech apps in one fell swoop.

Mobility & Travel

For mobility apps, car rentals, and travel services, identity and age checks are routine but often slow and paper-based. With ID Wallets, users can prove they’re over the legal age to rent a vehicle or check in to a hotel instantly.

Healthcare

In healthcare, onboarding patients securely while respecting privacy is essential. Traditional systems often involve repeated form-filling and data collection. ID Wallets let patients prove their identity and share only what’s required — such as age, insurance status, or medical credentials — without exposing full personal data.

Get started with Gataca

Traditional KYC has served its purpose, but its limitations are now holding businesses back. Users now expect speed, privacy, and control, and regulators are backing that shift.

However, implementing ID Wallets independently is complex and this is where Gataca provides a clear advantage.

Instead of building from scratch, organizations can leverage a turnkey solution with no need for deep technical expertise or lengthy setup, just plug in and go with Gataca.

Esther Saurí

Digital Marketing Specialist